*Note: the change in the law does NOT affect the amount of DIC you receive from the VA.

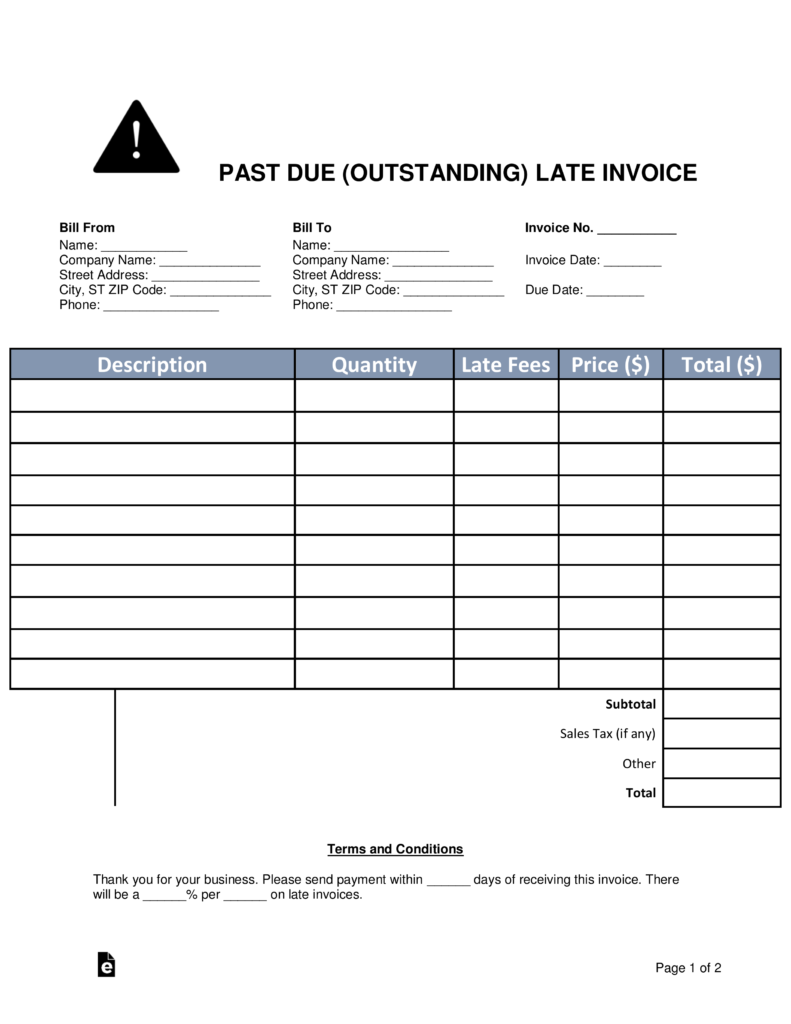

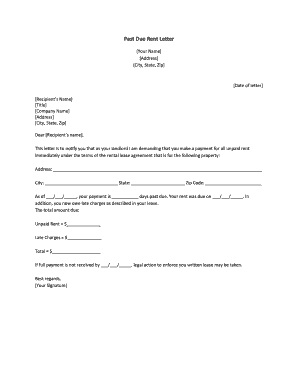

Due to due from accounting full#

The first payment for Phase Two was February 1, 2022. See our full range of FAQs on the SBP-DIC News webpage. In Phase Two of the SBP-DIC Offset Phased Elimination, which began January 1, 2022, the amount that is offset (deducted) from the spouse’s SBP annuity payment will be one-third of the amount of the DIC payment. SBP-DIC OFFSET PHASED ELIMINATION - Phase Two Began January 2022 - Check Out Our New Quick Reference Guide!

Due to due from accounting how to#

Find out how to log onand update your contact information so you never miss a message. We created a new kind of myPay account especially for Gray Area Retirees! This account will help you stay connected to important news and updates between the time you retire from Service and the date you’re eligible to receive retired pay. IMPORTANT NEWS FOR RESERVE AND GUARD GRAY AREA RETIREES MILITARY HOUSING AREAS: A temporary increase for BAH rates for service members in certain areas can help offset rising rental housing costs due to the COVID-19 pandemic. Read more about the debt pause and other measures put in place to assist Out of Service debtors…ĭOD TEMPORARY BAH RATE INCREASES AFFECT 56 U.S. On October 1, 2021, this hold lifted and the DFAS Debt and Claims Office began mailing out Debt letters to affected individuals. See details here.ĭFAS OUT-OF-SERVICE DEBT PAUSE LIFTED AND NOTIFICATIONS RESUME: Beginning in March 2020, DFAS put a hold on notifying and collecting new Out-of-Service debts in order to provide financial relief to debtors. Members of the National Guard and Reserve with remaining OASDI debt now have a new option for payment. SOCIAL SECURITY WITHHOLDING TAX DEFERRAL FOR NATIONAL GUARD AND RESERVISTS - NEW PAYMENT OPTION Check it to find out about matters affecting your pay, schedules for important documents and how our people are making a difference in how DoD does business. The numbers far surpass initial numbers from January that estimated only 1.6 million full-time workers were out due to long COVID-19, giving possible answers as to why there are still labor shortages more than two years after the pandemic.EXPANDED DFAS NEWS is now available in our Pressroom. “To give a sense of the magnitude: If the long Covid population increases by just 10% each year, in 10 years, the annual cost of lost wages will be half a trillion dollars.”ĬLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER “If long Covid patients don’t begin recovering at greater rates, the economic burden will continue to rise,” wrote Katie Bach, a nonresident senior fellow at Brookings Institution. Of those, between 1.8 million and 4.1 million have reported being forced out of work because of those symptoms, resulting in an annual loss of $170 billion in wages, according to data compiled by the Brookings Institution. More than 16 million adults have reported experiencing long COVID-19, which occurs when one experiences coronavirus symptoms for three months or longer, making up about 8% of the working-age population. As many as 4.1 million people may still be out of work due to symptoms caused by “long COVID-19,” accounting for roughly 2% of the U.S.

0 kommentar(er)

0 kommentar(er)